You might be wondering how much money is allowed in a savings fund. We'll be discussing the average savings account balance, the Three to Six-Month Rule of Thumb and any fees that might apply for keeping your money. Next, we'll discuss how to select the best savings account. The average savings account balance is $41,600, and we'll talk about Fees and Interest rates to help you choose the best one for your needs.

Average savings account balance of $41,600

The average American household now has $41,600 in savings, up from $53,300 in 2012. According to Bankrate's survey. Similar to the above, the median amount of savings accounts varies according to age. The 2019 Survey of Consumer Finances only addresses households with active transaction account accounts. It is triennial. The average savings account balance however is $41,600. All dollar amounts are shown in 2019 dollars. This data is a good indication of the financial stability of the average American.

According to the latest US Federal Reserve survey, Americans have an average savings account balance of $41,600. This is down from $5,300 in 2012. This means that the median savings account balance of the American population is just above $16,000. According to the survey the average savings rate for American households was 4.4%. This is significantly less than the 6% level earlier in the year.

Three-to-six-month rule of thumb

The three-to-6-month rule for how much money to put in a savings account is a good recommendation. However, the amount that you should have in your account will vary depending on your lifestyle. Saving three to six months' worth of essential expenses is a good rule of thumb, although this number may be low for lower-income households. To calculate your exact savings amount, review your bank statements and add up your essential bills. These include rent, mortgage payments, insurance premiums, debt repayments, groceries, and money that you spend on transportation. In general, you should keep at least three to six months worth of expenses in your savings.

Budgeting your expenses is a great way of calculating your emergency savings. You can save between three and six months of expenses if you have a steady job. However, if you are self-employed, it is possible to save more in the event of an emergency. Single parents need to save at least one calendar year worth of expenses. Married couples should save as much as three to six monthly incomes. These factors are important to consider for investors.

Interest rate on savings account

The Interest rate on your savings bank account will be calculated daily, based on the lowest balance you have in the account. The schedule of the bank will determine how often they calculate your interest. Interest is generally paid on the balance of the month. A savings account can earn a higher interest rate if it is kept for a longer time.

The Interest Rate on Savings Account is variable, meaning that the banks have the discretion to raise or lower the interest rate they offer. The more competition there is, the more variable the savings account interest rates. The Reserve Bank of India regulates savings account rates. Banks started offering higher interest rates in order to attract customers in 2011. Here is a list of some of the highest rates and lowest rates available for savings accounts.

Fees on savings account

It is crucial to know what fees are charged on savings accounts if you want your money to be the best it can be. Many banks fail make their fees and charges crystal clear. This can cause your balance to drop and lower your interest rate. Although banks will usually inform you about maintenance fees in writing, most don't make these fees explicit. Other fees are hidden in the fine print and can prove difficult to locate. It is important to understand the fees associated with your account before signing up for one.

If you make more than six withdrawals per month, you may be charged an excess transaction fee. If you withdraw more than the federal maximum from your savings accounts, this is an additional fee. Although there is a limit on how many withdrawals you can make each month, the coronavirus outbreak may allow for six. This fee could be as high at $30. If you regularly check your account balance, you may be able to avoid these fees. But be aware that there are risks associated with overdrafts. If you're concerned about overdrafts, you should consider direct deposit. Direct deposit is a service that can keep your account balance low to avoid overdrafts.

FAQ

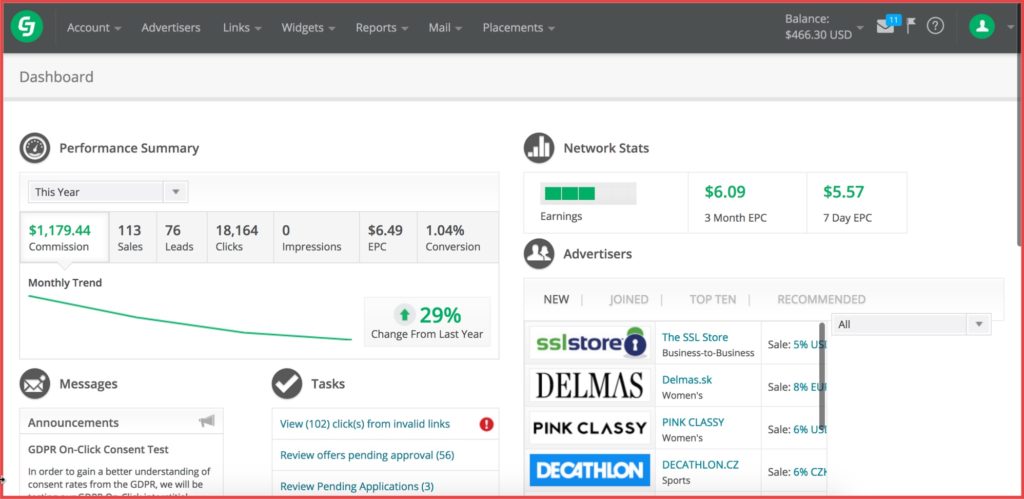

Are there any other good affiliate networks?

Yes! Yes. There are many other trusted affiliate networks. ShareASale is one example. CJ Affiliate, Commission Junction and LinkShare are all examples. Rakuten Marketing and Media.net are also good options.

They pay anywhere from $10 to $20 a commission on every sale. Affiliates will also find a variety of tools and features.

How much do online affiliate marketers make?

The annual average income of an affiliate marketer is $0-$100k.

Most of these people are self employed and have their own websites.

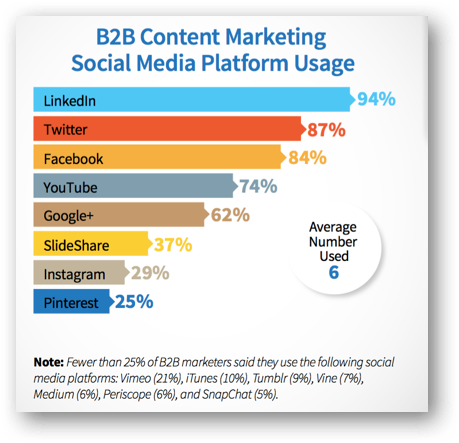

They use various methods to promote products on their sites, including banner ads, text links, contextual advertising, search engine optimization (SEO), social media marketing, etc.

The majority of affiliates make between $50-$100 for each sale.

Some affiliates may earn as much as $1000 per sale.

Which affiliate network is best for beginners?

Amazon Affiliate Program is a great affiliate network. It is possible to get started with the program without investing. This is one of the most renowned affiliate networks.

Consider joining Amazon Associates if you are interested in the Amazon Affiliate Program. This is another affiliate network where you can earn commissions by referring customers to Amazon.com.

How can I make money through affiliate marketing?

Affiliate marketing is one way to make easy money online. It doesn't take much to make money online. Register for an affiliate program. Find a product you like, promote it, get paid when someone buys.

You can also market multiple products simultaneously if you so desire. Only promote products that you are knowledgeable about.

Statistics

- According to research by Marketo, multimedia texts have a 15% higher click-through rate (CTR) and increase campaign opt-ins by 20%. (shopify.com)

- The latest stats show that 87% of marketers use email marketing to distribute content. (shopify.com)

- Backlinko found that the #1 organic result is 10 times more likely to receive a click compared to a page in spot #10. (shopify.com)

- Instagram is the most popular channel, with 67% of brands using it. (shopify.com)

- According to the Baymard Institute, 69.82% of shopping carts are abandoned. (shopify.com)

External Links

How To

These Tips Will Help You Become a Successful Affiliate Marketer

Affiliate marketing is a great way to make money online. These tips will help you succeed.

Finding products that are in high demand is the first tip. This means that you should look for products that have a lot of customers and are already selling well. This will allow you to save time and effort as you won't have the product created from scratch.

Additionally, you should look for products that offer a high potential for growth. One example is a book that has a large following. Perhaps you want to promote a videogame that's been out for years. These products are more likely grow in popularity and make great affiliate marketing opportunities.

Avoid promoting products that do not relate to your niche. A weight loss program would not be recommended to someone who isn’t concerned about his or her appearance. It's not fair to suggest a diet to someone who just wants to lose weight.

Last but not least, focus on products that can be easily promoted. This means you shouldn't spend too much time figuring out how to promote a product. Instead, look for products that have numerous testimonials and reviews.

These tips can help you be a successful affiliate marketing professional.